Hong Kong's ETF Market – What Is Driving Investor Demand?

4.9

$ 2.99

In stock

(594)

Product Description

Hong Kong's ETF Market – What Is Driving Investor Demand?

Hong Kong stocks on edge of bear market as contagion fears mount

Survey finds investors outside Hong Kong and Exchange Participants' principal trading are driving trading growth in HKEX's securities market

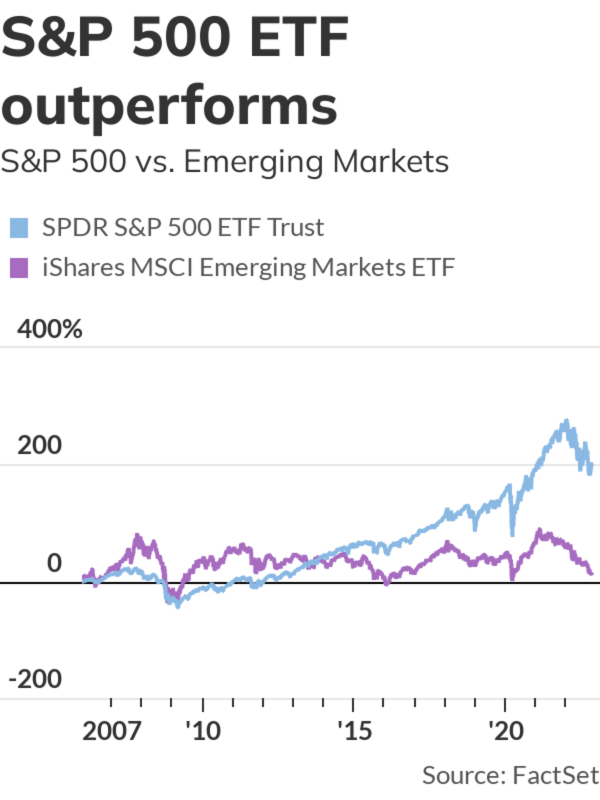

Emerging-markets ETFs are 'burning investor cash' as China drags down performance - MarketWatch

HKEx Reports on Hong Kong ETF Market as a Door to Global Investment - Charltons Quantum

Tracker Fund shows US investors the door

Mainland investors show strong demand for Hong Kong ETFs - Fund Selector Asia

Samsung Bitcoin Future Active ETF to Hit Hong Kong Stock Market on Jan 13

PwC Hong Kong: The Next Big Leap for ETFs in Hong Kong

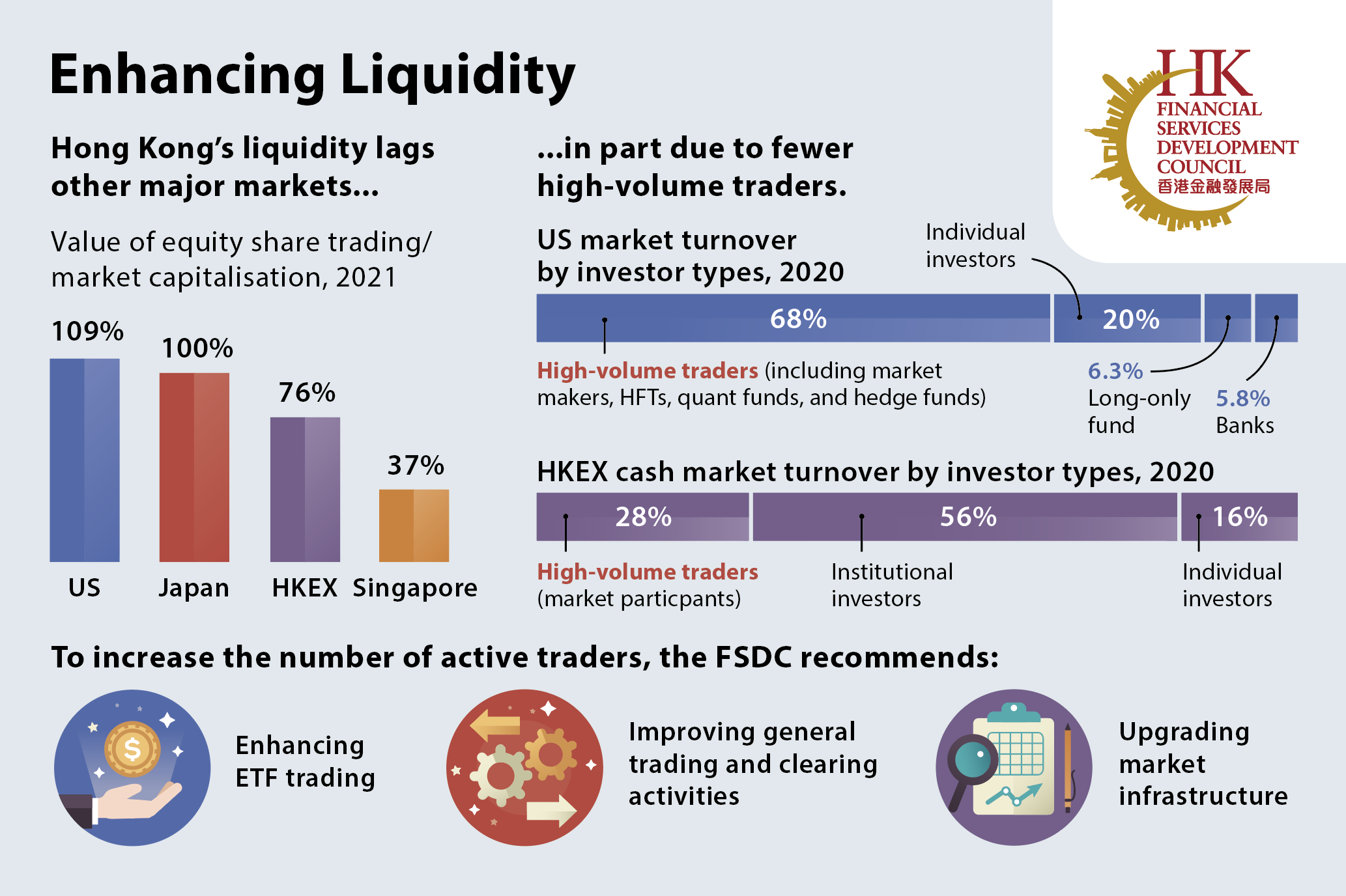

Enhancing Hong Kong's market liquidity

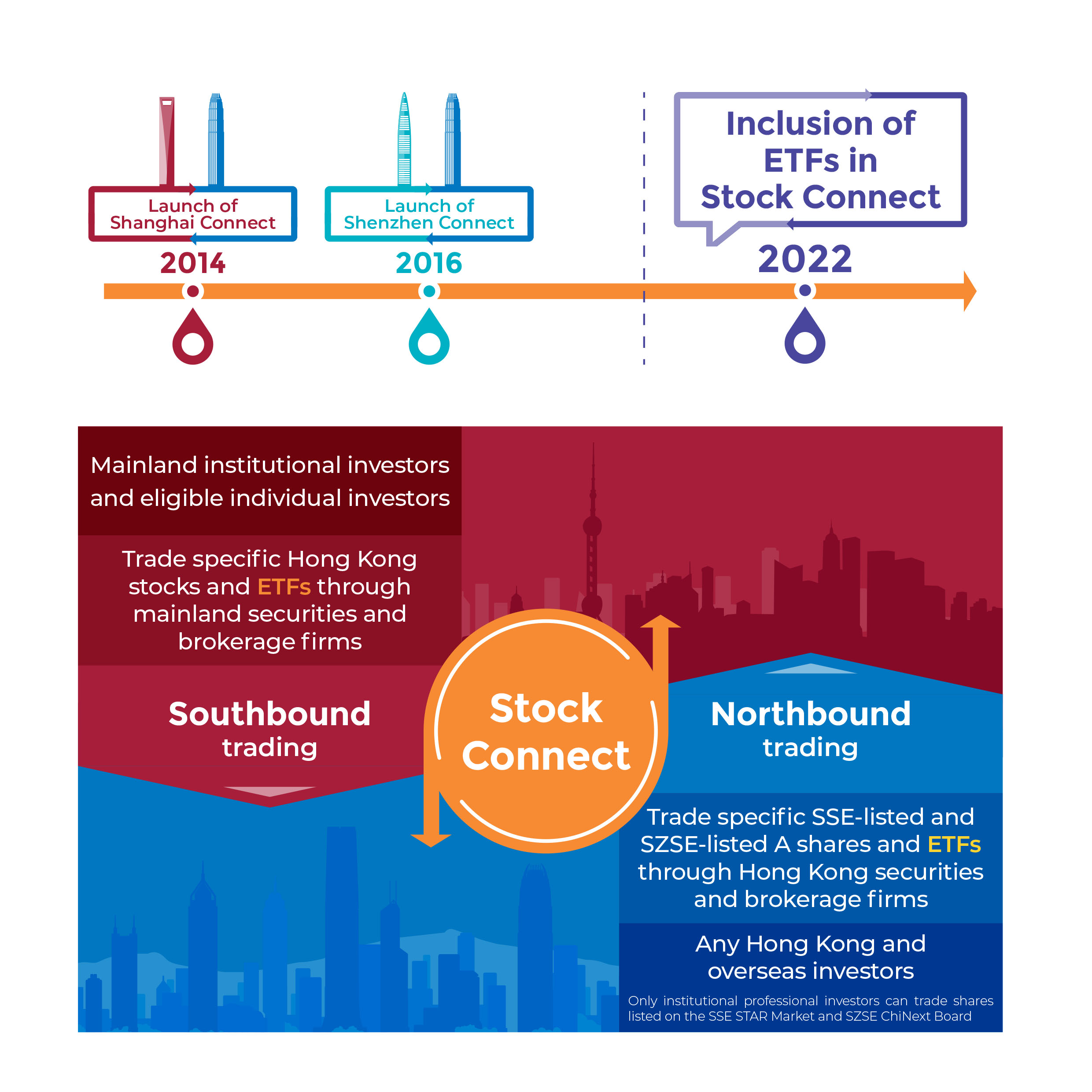

ETF Connect - Basic Concept

Mainland investors show strong demand for Hong Kong ETFs - Fund Selector Asia

Panicked Fed Slashes Rates to Near 0%, Throws $700 Billion QE on Top, after $1.5 Trillion Shock-and-Awe Repos Fizzled. Stock Futures Plunge 5%, Hit Limit Down